Tokenization: Digitizing Assets on the Blockchain

In recent years, blockchain technology has proven to be a game-changer in various industries. This is because of its ability to create a transparent and immutable digital ledger, enabling secure data sharing and storage, and decentralized systems. One of the revolutionary use-cases of the blockchain is tokenization. This process digitizes assets, enabling them to be traded, divided, and stored on the blockchain. This post will explore what tokenization is, how it works, the benefits it offers, and some significant challenges.

Definition of Tokenization

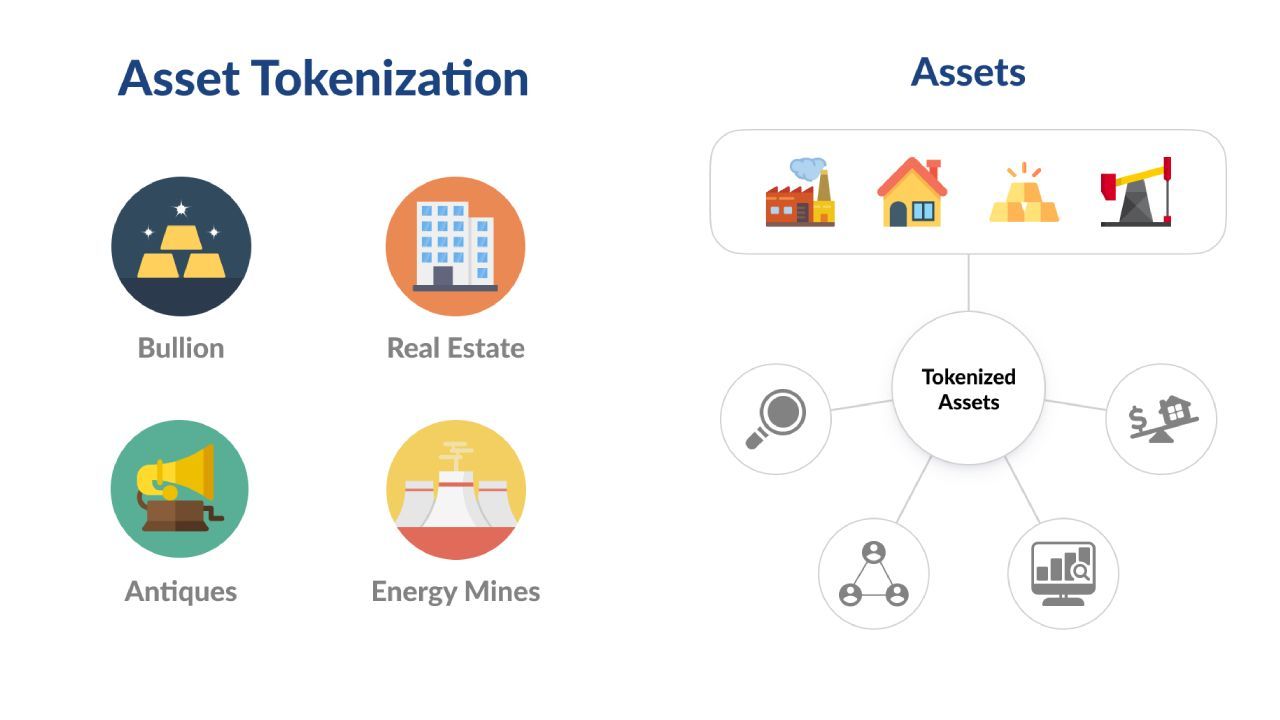

Tokenization refers to the process of converting real-world or physical assets into digital tokens that represent their value. Tokens can represent anything of value, including real estate, artwork, intellectual property, and even collectibles. As a result, the tokenized assets can be traded and transferred on a blockchain network, enabling new forms of liquidity and fractional ownership.

How Blockchain Technology Enables Asset Tokenization

A blockchain is a peer-to-peer network that can facilitate the decentralized storage and distribution of digital assets. Blockchain technology enables tokenization by providing secure, immutable data storage and smart contract functionality. Smart contracts are self-executing code hosted on the blockchain that automatically enforce contractual terms, allowing for automated asset management and distribution.

Tokenization Process

There are four main stages involved in the asset tokenization process:

Creation of Digital Tokens

The process starts by creating digital tokens that represent the asset. Token issuers can control and customize the token's features, including the number of tokens issued, their value, and the rights and privileges they confer.

Tokenization Standards

Tokenization standards, such as ERC-721 and ERC-1155, define the rules and requirements for creating, issuing, and trading tokens on the blockchain. Standards provide interoperability between different blockchains, making it easy to exchange tokens across different networks.

Token Issuance and Distribution

The tokens are then issued to investors via an initial coin offering (ICO) or security token offering (STO). The tokens' distribution can be automated through smart contracts.

Secondary Market Trading

Once the tokens are issued, they can be traded on secondary markets. As tokens are digital, they can be traded 24/7, providing investors with greater liquidity.

Benefits of Tokenization

Tokenization offers several benefits compared to traditional asset ownership models, including:

Liquidity

Tokenization enables fractional ownership and secondary market trading, allowing investors to buy and sell assets without intermediaries. This increases liquidity and reduces the costs associated with traditional asset trading.

Cost Efficiency

Tokenization reduces the costs associated with traditional asset management by automating asset distribution and reducing intermediaries. This makes it easier for smaller investors to participate in larger asset classes like real estate.

Transparency

Blockchain technology provides an immutable ledger of all transactions and activities related to tokens, making it easy to validate transactions' authenticity and ownership.

Fractional Ownership

Tokenization allows assets to be divided into smaller units, enabling fractional ownership. Fractional ownership makes it easier for smaller investors to access larger assets, such as real estate holdings.

Use Cases

Tokenization has significant applications in various industries, including:

Real Estate

Tokenization enables fractional ownership of real estate assets, reducing the cost barrier for small investors to participate in the real estate market. It also makes the buying and selling process of properties more efficient.

Artwork

Artwork can be tokenized to provide investors with fractional ownership opportunities. This allows investors who would otherwise have been excluded from the high-value art market to participate.

Intellectual Property

Intellectual property tokens can represent royalty rights earned from creative works, enabling creators to monetize their content through digital crowdfunding.

Collectibles

Tokenization allows the fractional ownership and trading of unique collectibles such as sports memorabilia, historical artifacts, and rare coins.

Challenges and Risks

Tokenization faces challenges and risks, including:

Legal and Regulatory

Tokenization is a relatively new concept, and legal and regulatory frameworks are still evolving. This presents uncertainties around compliance and jurisdictional differences.

Technical

Tokenization requires the proper technical infrastructure to ensure secure storage and safe transactions of digital assets.

Governance and Control

Tokenization can challenge traditional asset ownership and control models, which can lead to governance issues.

Cybersecurity

Tokenization is vulnerable to cyber-attacks and hacking, making it crucial for companies to invest in robust cybersecurity measures to protect their digital assets and investments.

Conclusion

In conclusion, tokenization provides new opportunities for investors to participate in asset classes previously inaccessible. The benefits include increased liquidity, cost efficiency, transparency, and fractional ownership. However, tokenization still faces challenges around legal and regulatory frameworks, technical security, governance, and cyber risks. The future of tokenization looks promising, and the industry must overcome these challenges to unlock its full potential.